What we learn from history

…is that people don’t learn from history – Warren buffet

Ben Raven

June 2022

Market crashes and economic downturns are a part of life. Market calamity can occur seemingly out of nowhere and whether it be a dotcom bubble, a financial crisis, Brexit or Covid-19, we can never predict the full impact of a new market crash. We can however forecast that its effect on the markets, and the wider economy, will ultimately be temporary.

When faced with such a calamity, investors can choose to let emotions such as fear and anxiety drive them to sell into a falling market. They could be forgiven for doing so as crashes follow a set pattern; a whiff of fear which is then stirred by a media frenzy, creating mass panic and a spiralling fall in stock prices. However, they could equally choose to ride out the storm which historically doesn’t take too long to blow over. Research shows that the average duration of a bear market is about one year, compared with approximately four years for the average bull market. The average decline of a bear market is 30%, while the average gain of a bull market is 116%.[1]

The media will always sensationalise what is happening during a bear market. Papers don’t sell en masse when the headline reads “markets crashed yesterday but don’t worry a recovery is almost inevitable”. Instead, their dramatic coverage sparks waves of irrational behaviour throughout society.

Faced with this, should one decide to sell their investments, they may actually feel an initial sense of relief at having cut their losses while they take refuge in safer havens which provide scant returns. In doing so, they are likely to incur trading costs. They are also more likely to buy back in once they see the market begin to recover – at which point they will incur a second wave of costs.

It can be challenging to remain invested as market prices decline, however, history would suggest that a bear market is temporary and when it does end, the subsequent bull market can erase the declines and even extend the gains of the previous bull market.

The big risk for the investor who does incur two rounds of costs during the downturn, is missing out on the days when the market rises the most. Timing the market is almost impossible. Investors who engage in market timing will invariably miss some of the best days. Historically, six of the ten best days in the market occurred within two weeks of the ten worst days.[1] For more information on the significance of missing out on a handful of the best trading days, see our previous blog “Why does trying to ‘time the market’ so often fail?”.

It sounds counterintuitive, but the best market days are often intertwined with the worst. In fact, in the past 20 years, 50 percent of the S&P 500s strongest days occurred during a bear market.[2]

With this in mind, an alternative route to our risk averse investor would be, instead of selling on the way down, to buy at a discount once prices have fallen. Accumulating more shares, even as stocks fall, allows one to build a portfolio on a lower cost basis. If one keeps the focus on their long-term investment strategy, emotions like fear and greed shouldn’t affect their course of action. If one contributes a certain amount to their portfolio each month, there is an argument to say they should continue doing that despite market ups and downs. If the target allocation is 80% stocks, 20% bonds, one could re-allocate when stocks drop to restore their target weights at a relative discount.

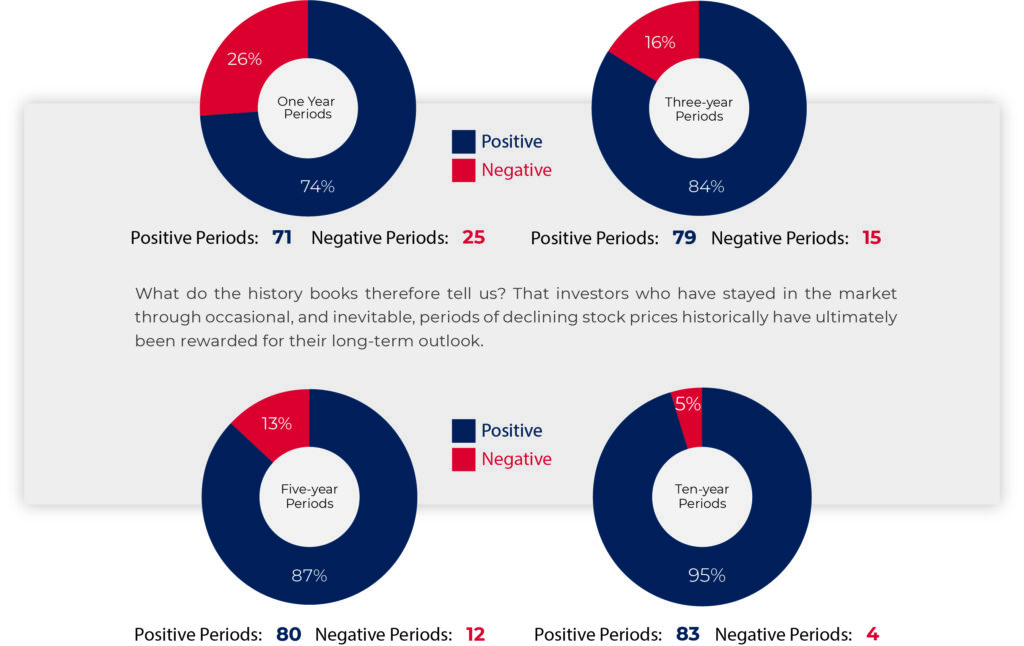

In the 96 years since 1926 the S&P 500 has had 71 positive returns compared to 25 negative returns (74% positive returns). History shows that the longer we make this period, the greater the chances of a positive outcome; 84% of 3-year periods were positive ones, 87% of 5-year periods were positive ones and 95% of 10-year periods were positive ones.

The longest bear market in U.S. history was 2.5 years long (2000-2002). The next longest was the 1930 to 1932 bear market which lasted 2.1 years. The biggest drop in a bear market came between 1930 to 1932 when the stock market dropped 83% over 2.1 years.[1] In isolation, any such scenario is a daunting one, however on the assumption that a portfolio has been appropriately constructed, taking into account a client’s age, risk profile, capacity for loss and specific time horizons, these bear markets will come to an end and the very best days in which to be invested, will arrive.

So, how can we benefit from history and stay calm during a bear market?

A methodical plan can detail your goals and investment strategies as well as instruct you to stay the course in the event of a drop in prices (short term or prolonged). If that doesn’t suffice, getting out the history books and refreshing oneself on the long-term behaviour of markets can never hurt.

[1] Kiplinger. “10 Things You Must Know About Bull Markets.” & LPL Research. “Six Things to Know About Bear Markets.”

[2] J.P. Morgan. “Guide to Retirement,” Page 41.

[3] https://deepinthetrenches.com/missing-the-best-days-in-the-market/

[4] Yardeni Research. “Stock Market Briefing: S&P 500 Bull & Bear Market Tables.