Bubbles and dividends

Written by Steve McGregor

As I wrote in late January, it has been a volatile start to 2022.

For the last couple of years, markets have enjoyed central banks pumping lots of money into the system and Governments adopting a friendly taxation environment. This has led to healthy gains for many asset classes, despite the difficulties a global pandemic presented. Some would say a bubble has formed. This year however, inflation has risen to levels not seen for many years and has stayed there. Central banks have reacted by raising interest rates and pumping less money into the system. The bubble could get bigger still, but it is also very possible that it may burst. As a result, investors have started to take profits, especially in expensive areas such as US technology stocks which have risen significantly over the last couple of years, causing a bout of risk aversion. This doesn’t come as a huge surprise; we wrote about the risks in our Market Outlook just before Christmas.

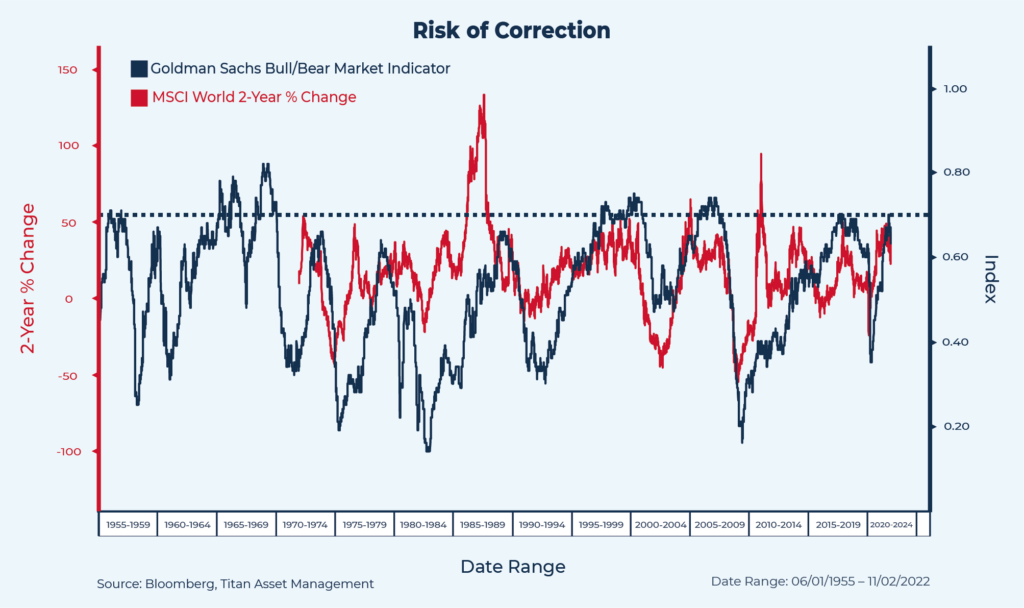

The chart shows the Goldman Sachs Bull / Bear market indicator, which has a good track record for flagging market tops. Previous market corrections such as in 1973, 2000, 2008 and 2020 (amongst others) are all shown by a fall in the blue line. As you can see, we are currently in the danger zone, with another sell off possible.

“Markets don’t go up forever and given the run we’ve been on; a market correction was inevitable. All of that said, with inflation likely to remain high throughout 2022, opportunities to generate a positive return will be there but careful asset allocation is key.” – John Leiper

As equities look set to outperform bonds in an inflationary environment, asset allocators are incentivised to look to dividends and high dividend paying stocks as a source of income over the coupons (income) generated from bonds. Furthermore, from a historical perspective, dividend paying strategies have tended to outperform in times like these and if inflation does persist, then the best place to be is in those companies positioned to benefit from rising rates, that have pricing power and can deliver dividends.

One theme that ticks all those boxes is dividend-paying European and UK equities which have lagged their US peers over the last couple of years.

Opportunities

• Equities versus bonds

• Commodities and commodity-linked equities, which perform well in an inflationary environment

• Dividend paying equity strategies, given the low coupons (income) generated from bonds

• Over-sold areas such as UK equities and European equities, offering attractive dividend yields

For a more detailed commentary, look at John Leiper’s latest blog below: