The high cost of cashing out

Why disinvesting and moving into cash could cost you in the long term.

Timing the stock market is next to impossible. No one knows exactly what markets will do, but it’s important to remember that the best and worst trading days often happen close together.

Why staying invested now could benefit you in the future:

• History tells us that over the long term, equity returns are significantly higher than cash

• Cash rates may seem more attractive now, but with inflation running at just below 11%, cash is still delivering negative real returns

• Moving to cash means you cannot participate in any market recovery, which often follows a market fall

• Equity markets have historically recovered from a downturn to deliver positive returns in excess of inflation

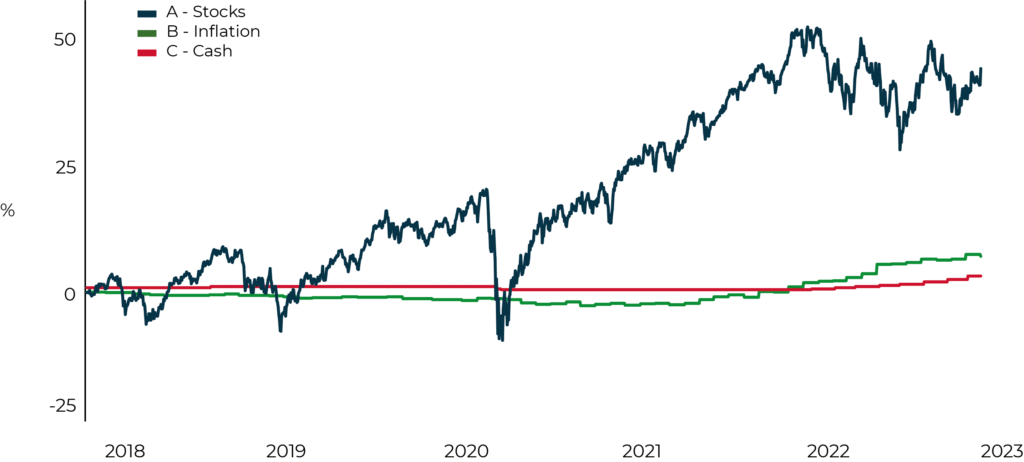

The below chart shows how over the last 5 years the stock market has continually delivered positive returns after a downturn, and why moving to cash could cost you in the long term.

Source: Lipper for Investment Management

Date of data: 22/11/2017 – 30/11/2022

A – MSCI World TR in GB

B – UK Consumer Price Index TR in GB

C – Bank of England Base Rate TR in GB